This Is the Main Heading You Can Edit

What is Secured Business Loan?

A secured business loan is designed to provide businesses with the necessary capital while offering greater security to lenders. Unlike unsecured loans where no collateral is required, secured business loans require you to pledge assets, such as real estate, equipment, inventory, machinery, or accounts receivable. The collateral acts as a safety net for lenders, mitigating the risks of default and allowing them to offer loans at more favorable terms and conditions.

advantages of a secured business loan.

Secured business loans come in handy for companies looking to fund their business expansion, launch new product lines, augment their infrastructure, and address their working capital needs or any other critical needs. However, it is advisable for business owners to thoroughly assess their capacity to repay the loan, as any default may result in the forfeiture of the pledged assets.

One of the key advantages of a secured business loan is that it enables entrepreneurs to access larger loan amounts compared to unsecured options. Additionally, it comes with more lenient eligibility criteria, making it accessible to a wider range of businesses, including startups or those with less-than-perfect credit histories. Usually, secured business loan interest rates start from 10.65% onwards and can be availed for a maximum tenure of 10 years.

Secured Business Loan Eligibility

Before you go ahead and apply for a secured business loan, it is important to check the eligibility criteria for it. Here is a snapshot:

- The borrower must be an Indian resident, either salaried or self-employed.

- The borrower must be in the age group of a minimum of 21 years and a maximum of 70 years.

- The primary borrower can select a co-applicant to extend the business loan eligibility limit and get the best business loan interest rates.

- The co-applicants can be partnership firms, close relatives, or private limited companies.

- The entities eligible to be borrowers for a secured business loan include shopkeepers, wholesalers, retailers, micro and small manufacturing enterprises, and self-employed professionals.

- Properties covered include residential, commercial/mixed-use properties, and industrial built-ups.

- Loan to Value on the properties goes up to 65%.

- Transactions covered include Loan Against Residential Property, Balance Transfer of Loan Against Residential Property along with top-up, Non-Residential Purchases, and balance transfer of Non-Residential Purchases.

Secured Business Loan Benefits

- Assets For Security: In many cases, a small business may not be eligible for an unsecured loan. However, a business always owns valuable assets, which can be pledged against a secured business loan, making it convenient to meet various financing needs.

- Maximising Your Asset’s Value: A secured business loan helps in unlocking the potential and value of your asset. You can maximize the potential and value of your assets to fulfill your business finance needs.

- Quick Approval: Small business owners can easily apply for a secured business loan and get approvals in no time with minimal documentation. There are various tools to help you know if you match the eligibility instantly.

- Complete Transparency: IIFL Home Loans ensures maximum transparency in the application and sanction of a secured business loan to the borrower. At every step, you will have complete clarity on everything you need to know.

FAQs

MSME loan is the best way for small businesses to scale up and increase their business footprint. The secured business loan interest rates are much more economical and lower than those of unsecured business loans.

Offer competitive interest rates for MSME Loan or startup business loans, which start from 10.75%*. However, these may depend on various factors.

A secured business loan helps in business expansion, purchase of machinery/equipment investment in new projects, etc. However, before you apply for a secured business loan, there are a few things you need to include in your checklist, such as:

Business and Personal Credit Score

Both your business credit score and your credit score play an important role in the business loan application process. If you find your score is low, you should strive to increase it.

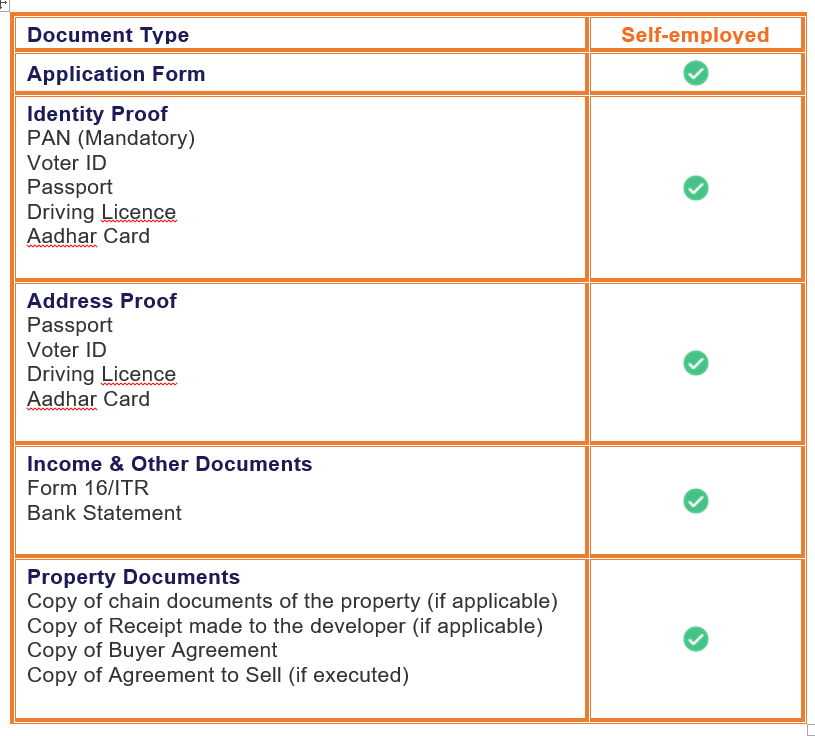

Eligibility Criteria and Documents Required

You need to check the business loan eligibility criteria before applying with a particular lender, as requirements vary from one financial institution to another. Once you match this, make sure you possess all the documents required by the financial institution of your choice.

Solid Business Plan

Before you go ahead and apply for a business loan, you should be sure of your objectives, fund utility, revenue model, and repayment plan. Having a thorough business plan in place can make it easier to obtain a loan at favorable terms.

Fill Out the Application Form Carefully

Make sure to pay attention to every little detail and not make even a small error. In many cases, a small error can lead to your application being rejected. If you have any doubts, you should resolve it with the lender before filling out the form.

The processing fee is one of the fees and charges that you will be required to pay when taking a home loan. This fee is charged on a home loan as a one-time charge by the lender upon the acceptance of your home loan application. All lenders in the market don’t need to charge you a processing fee, some might and some might not.

- A minimal one-time processing fee.

- Late payment fee (in case of delays in repayment).

- Miscellaneous charges such as collateral evaluation, stamp duty, documentation, amortization charges, collection of registration certificates, etc. as applicable.

- A minimal pre-payment charge.

- The following is the list of fees & charges applicable to Loans:

Processing Fees Up to 2% of the loan amount approved

Late Payment Charges 18% per annum on the overdue loan amount

Collateral Evaluation Charges Starting From Rs 5,000*

As per the borrower’s needs, the interest rate policy, the purpose, and the loan tenure, lenders usually use different modes to calculate the repayment schedule. Some of the common business loan repayment options are:

Equated Monthly Instalments (EMIs)

This type of payment schedule enables borrowers to make payments in equal parts via scheduled monthly payments. The total EMI amount includes both principal and interest components of the business loan.

Bullet Payments

In this type of repayment mode, the borrower pays the accumulated interest during the tenure of the loan for small business and pays the principal amount at the end of the tenure. This is usually extended only for a fixed term.

Prepayment

You can opt for the prepayment mode in which you end up paying the loan amount before the tenure ends. This is usually the option for those borrowers who have accumulated cash and want to clear all their dues as soon as possible. However, a penalty may apply depending on the lender’s business loan policies.

Electronic Clearance Service (ECS)

This method is usually for those borrowers who do not have an account in that financial institution. It allows the lender to deduct the principal amount from the bank account chosen for the repayment plan.

Note: Please check with the lender about the repayment options when applying for the loan.

Typically, the repayment period starts once your Business Loan has started within one month of the Business Loan amount being disbursed. However, every lender might have their terms and policies for the same.

The business loan or sme lending requires a collateral, which is essentially a property asset. The loan amount is offered after evaluating the current market value of the property. In case the value of the mortgaged asset is high, the loan amount is also high, and the loan term is longer.

our banking partners :

Why opt for Apex Credits for Home Loans?

Apex Credits is a leading financial Service Provider that provides comprehensive business loan options to meet your financial needs and fulfill your business goals. Apex Credits Home Loans also gives you the option to transfer your existing balance to get finance at better business loan interest rates and more flexibility.

We also offer loan for small business with minimal documentation and quick disbursals. You can easily apply for a business loan online with Apex Credits Home Loans and enjoy competitive interest rates and flexible repayment schedules.

Apex Credits offers New Home loans, Home Extension or Improvement loans, NRI Home loans, Balance Transfers, and loans against Properties at competitive home loan rates. We are also known for our unparalleled customer service with a quick turnaround time. We provides housing loans with minimal documentation and quick disbursals. You can easily apply for a home loan online with us to avail all these benefits.

How Apex Credit Can Help You ? : At Apex Credit, we specialize in helping individuals secure home loans from multinational banks in India.